Forex Rollover

Contents:

Arollover credit is received by a currencies trader when they maintain an open position in a currency trade overnight that involves being long a currency with a higher interest rate than the one sold. A rollover debit, on the other hand, is paid out by the trader when the long currency pays the lower interest rate. It’s important to note that while the rollover rate can be a useful tool, it’s only one factor to consider when making a forex trade. Traders should also consider other factors such as market volatility, exchange rates, and risk management strategies when making a trade. The rolling rate would be 27.4, which represents the interest earned or charged for holding a currency position overnight.

When trading in the electronic forex market, trades take place in blocks of currency, and they can be traded in any volume desired, within the limits allowed by the individual trading account balance. For example, you can trade seven micro lots or three mini lots , or 75 standard lots . Forex refers to the global electronic marketplace for trading international currencies and currency derivatives. It has no central physical location, yet the forex market is the largest, most liquid market in the world by trading volume, with trillions of dollars changing hands every day. Most of the trading is done through banks, brokers, and financial institutions.

But there’s no physical exchange of money from one party to another as at a foreign exchange kiosk. The forex market is unique for several reasons, the main one being its size. As an example, trading in foreign exchange markets averaged $6.6 trillion per day in 2019, according to the Bank for International Settlements . Transactions in over-the-counter derivatives (or “swaps”) have significant risks, including, but not limited to, substantial risk of loss. This material has been prepared by a sales or trading employee or agent of Chatham Hedging Advisors and could be deemed a solicitation for entering into a derivatives transaction. This material is not a research report prepared by Chatham Hedging Advisors.

Rollover Rates

As a result, the forex broker either pays or deducts interest when you have a position that is kept open overnight. The calculation is based on the difference between base and quote currencies. Thus, it is needed to subtract the interest rate of the base currency from the quote currency’s interest rate. Then, it is needed to divide the result by 365 times the base exchange rate. Forex rollover is the amount of interest that you will either be credited or debited if you are still holding an open trade at the end of the trading day. Leverage has opened markets such as forex to more retail traders who don’t want to allocate large amounts of capital to each position.

Specialties include general financial planning, career development, lending, retirement, tax preparation, and credit. Research & market reviews Get trading insights from our analytical reports and premium market reviews. FAQ Get answers to popular questions about the platform and trading conditions. Now, we can get the actual rollover amounts that you will be charged. Non-spouse beneficiary rollover is performed in the event of the death of the account holder where the recipient is not the spouse of the deceased. Do your research before investing your funds in any financial asset or presented product or event.

Please note that foreign exchange and other leveraged trading involves significant risk of loss. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary. You can access our rollover rates directly from our trading platforms. You can also access our rollover rates directly from our trading platforms. Most forex exchanges display the rollover rate, meaning calculation of the rate is generally not required.

Forex rollover explained

The position will earn a credit if the long currency’s interest rate is higher than the short currencies interest rate. Likewise, the position will pay a debit if the long currency’s interest rate is lower than the short currencies interest rate. For tax purposes, the currency trader should keep track of interest received or paid, separate from regular trading gains and losses.

So, if the https://forexhero.info/ currency’s interest rate is 1% and the quote currency’s interest rate is 2%, then when you are long on base/quote, the interest rate differential is applied. Therefore, you will be paid 1% interest for the base currency while you will be deducted 2% interest from the quote currency. The first thing to understand a forex rollover is the interest rates that are at play. An indirect rollover is a payment from a retirement account to the investor for later deposit in a new account. On the other hand, your position will pay a debit if the currency’s long interest rate is lower than the currencies short interest rate.

Can I avoid paying rollover?

On the opposite side, traders might be charged if the purchased currency has a lower interest rate. If you don’t want your positions to be subject to these calculations, you need to close them by the end of the day. View Less Markets View All Markets Rollover rates displayed are based on a 10K position and estimated based on the previous rollover rate and number of days being rolled. For example, typically there are no rollovers on Fridays, and Wednesdays are rolled for three days to account for the weekend.

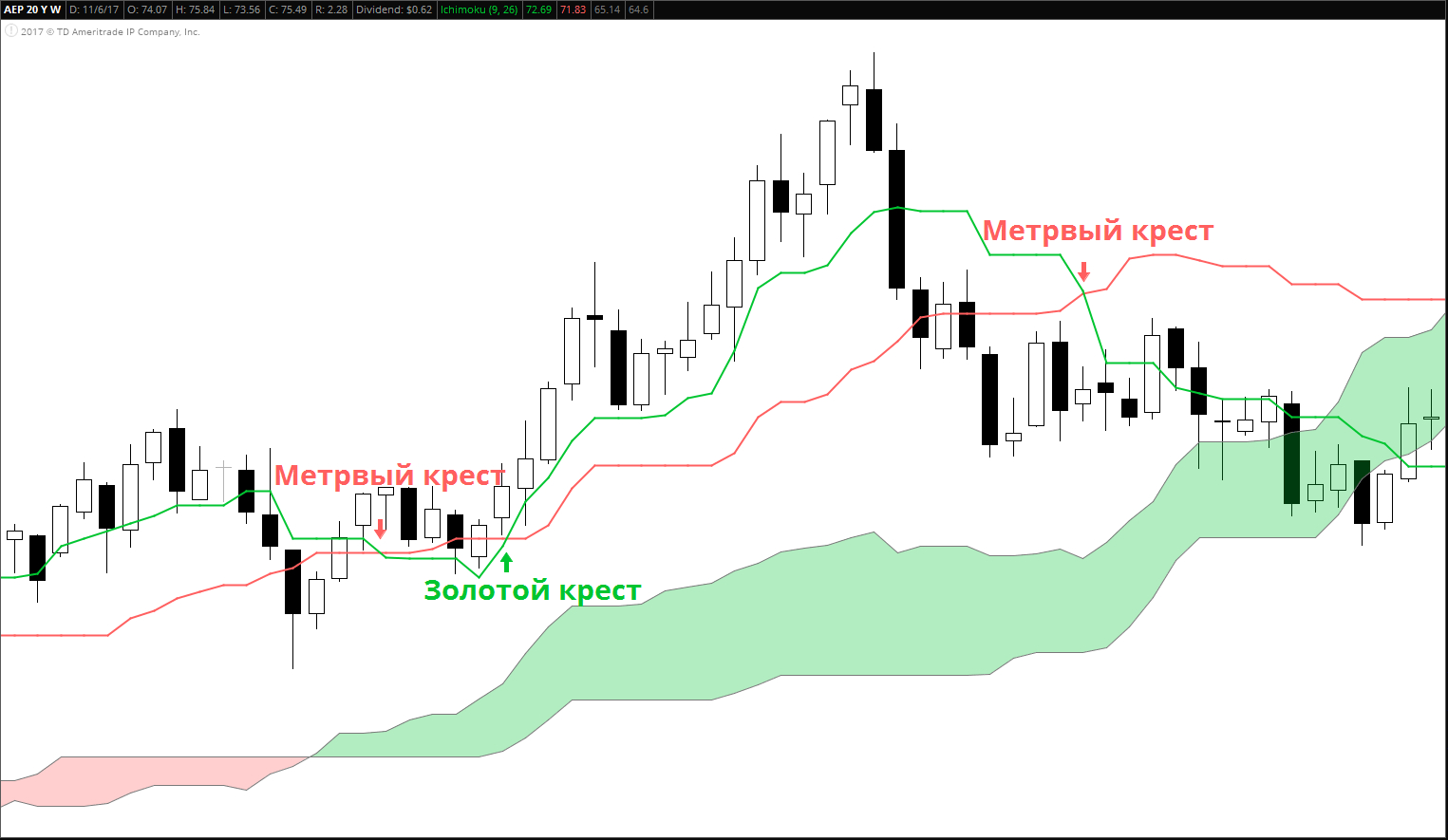

When determining whether to retain a long or short position, the swap rate is determined by comparing the interest rates of the two currencies. Market circumstances as well as central banks’ interest rate policies combine to set the rollover rates on Forex.com. It’s important to note that rollover rates can vary and depend on market conditions, so it’s best to check with your broker for the latest rates. Rollover can affect a trading decision, especially if the trade could be held for the long term.

There is even a forex trading strategy aimed at exploiting forex rollover to make profits. The rollover interest changes as the interest rates of the individual currencies in the pair change. So, many brokers automatically calculate and upload the rollover rates on their website. When you trade a currency pair in forex, you are not buying or selling the individual currencies. You are only speculating on their future exchange rates and hope to make profits when they move in the direction of your speculation.

Additionally, there are special conditions for holidays because of the banks. A holiday rollover normally takes place two days before the holidays. For example, before the US President’s Day on 18 February, the rollover is calculated at 5 pm two days before that for all US dollar pairs. On weekends, the forex market is closed for business, but rollover values are still being counted. Typically, forex books an interest amount equal to three days of rollover on Wednesdays. Holidays during which the forex market is closed still provide a rollover valuation and are accounted for two business days in advance.

$10 No Deposit Bonus – Open a Live STP account, $10 Bonus is automatically added to your account – FXOpen

In foreign exchange trading , a rollover is the action taking place at end of day, where all open positions with value date equals SPOT, will be rolled over to the next business day. This happens since in FX trading the trader doesn’t want to actually buy the traded currencies but to continue to trade until position is closed. For example, on Monday all position with value date of Wednesday (in case of T+2) will be rolled over and the value date will be updated for Thursday.

How to use the currency carry trade strategy – FOREX.com

How to use the currency carry trade strategy.

Posted: Tue, 25 Oct 2022 07:00:00 GMT [source]

Typically, the amount of https://traderoom.info/ is set forth by the market regulator, such as the NFA, and regulated brokers, such as FOREX.com, must adhere to these stipulations. The current price of each currency is supported by interest rate differentials, which in turn influence rollover rates. Apart from this, it is likely that rates will also fluctuate as a result of future changes to market fundamentals. It all depends on whether you are holding a long position or have shorted that particular pair.

Why should you pay attention to forex rollovers?

But consider the NZD/https://forexdelta.net/ currency pair, where you’re long NZD and short USD. Please click here to view a table that indicates how many days of rollover will be applied to open positions at 5pm EST on each trading day. An examination of the differences between swap rates and forex swap rates, however, clarifies their differences.

What Does Rollover Mean in the Context of the Forex Market? – Investopedia

What Does Rollover Mean in the Context of the Forex Market?.

Posted: Sat, 25 Mar 2017 18:48:38 GMT [source]

As a point of reference, “target” interest rates are established exclusively by a country’s central bank for their domestic currency and released to the public. Target rates are widely viewed by short-term traders as ballpark estimates of the actual interest rates that will be used in determining the rollover value for a specific trade. The first currency in the pair is the “base” currency, and the second is known as the “counter” currency.

About FXCM

A micro lot is 1,000 units of a given currency, a mini lot is 10,000, and a standard lot is 100,000. A great deal of forex trade exists to accommodate speculation on the direction of currency values. Traders profit from the price movement of a particular pair of currencies. Some of these trades occur because financial institutions, companies, or individuals have a business need to exchange one currency for another. For example, an American company may trade U.S. dollars for Japanese yen in order to pay for merchandise that has been ordered from Japan and is payable in yen. Cory is an expert on stock, forex and futures price action trading strategies.

- EST, rollover will be the difference in the value received for holding euros and the value paid for being short U.S. dollars.

- 100% Deposit Bonus – Receive a 100% Bonus on Deposits (Max Bonus $5,000).

- Specialties include general financial planning, career development, lending, retirement, tax preparation, and credit.

- For tax purposes, the currency trader should keep track of interest received or paid, separate from regular trading gains and losses.

- You can also access our rollover rates directly from our trading platforms.

- A rollover may entail a number of actions, most popularly the transfer of the holdings of one retirement plan to another without creating a taxable event.

Experience our FOREX.com trading platform for 90 days, risk-free. Understanding the concept of forex rollover and how it works will help you strategies effectively your trades. If you plan very well, you can reap from a rollover in forex trading. Nowadays, Calculating rollover interest rates in forex is simplified by the aid of a rollover interest calculator available online.